Instead of maxing out your credit cards to pay unexpected bills or finance a business opportunity, look no further than what’s in your jewelry box. A luxury watch, even if it’s old or shows wear, can dig you out of a financial hole. Consider the option to pawn a watch instead of getting further into debt.

If you don’t think your watch is worth much, you might be surprised at Capetown Capital Lenders. Many of our customers bring in watches passed down through family, and don’t realize their value.

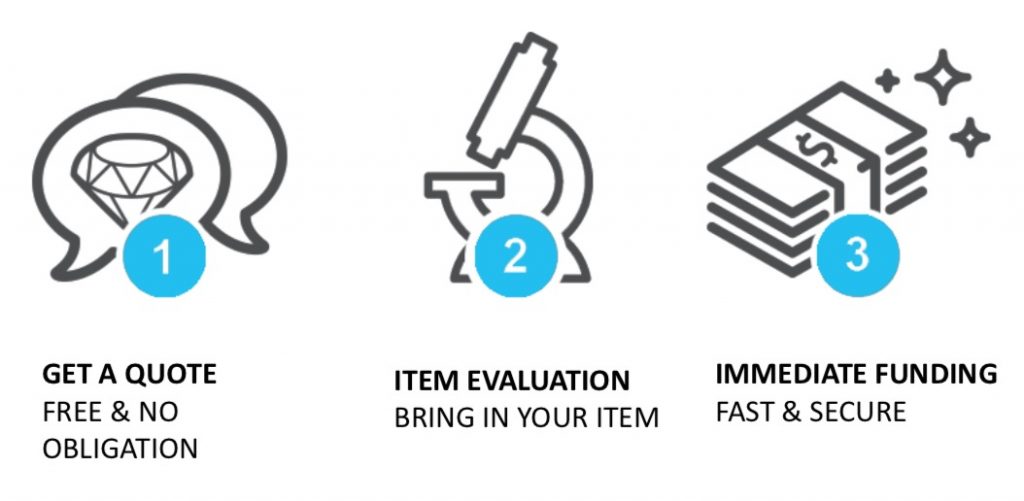

Here’s how it works:

Consider using your watch as collateral for an asset-based loan at Capetown Capital Lenders. It’s similar to choosing to pawn a watch, but faster and gives you more flexibility.

First, bring your watch into our Atlanta location, or fill out our online evaluation form with basic information. After we evaluate your luxury watch, we’ll send you an offer. If you decide to take the offer, you can get up to $1,000,000 in 24 hours or less.

Once you pay back your loan, the item is yours again. Choosing to pawn a watch with us gives you flexibility — you can choose the duration of your loan and can even extend it if necessary.

Who we are

Capetown Capital Lenders has the expertise, resources and security to deserve your business. Instead of visiting a local pawn shop, go to Capetown Capital Lenders for the best in short-term jewelry loans.

Since pawn shops accept many kinds of items to increase inventory, shops aren’t experts in any single field. For lots of industries, that’s fine. But in jewelry and watches, styles change so quickly that it’s best to work with an expert to get the largest possible value for your loan.Â

Capetown Capital Lenders also has the security and resources to finance your loan. Pawn shops are often the target of robberies and are small businesses, so they may have insufficient security. At Capetown Capital Lenders, every item in our store is under a jewelry-specific insurance policy and kept in our secure vaults.Â

Ready to get a loan with your watch?

Visit our Atlanta location or fill out our online evaluation form.